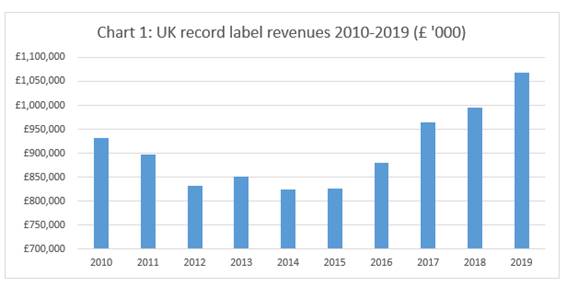

£1.1 billion UK record labels' trade income at highest level in over a decade

17 March 2020 - Press releaseInvestment in new music, and growth of streaming and vinyl drive revenues up 7.3%, but the long-term health of music ecosystem still requires key reform, says BPI boss

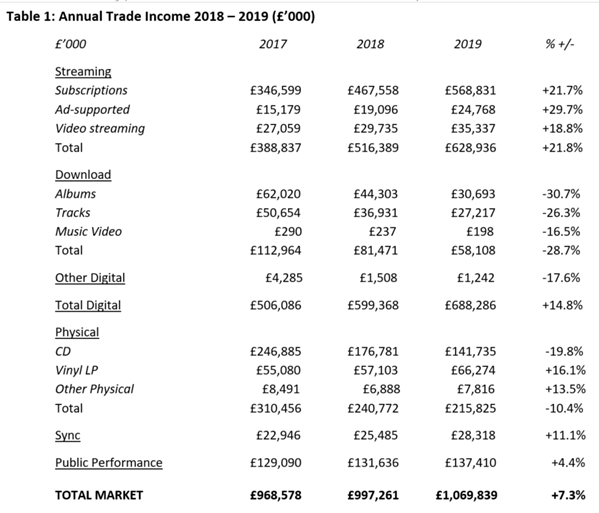

The BPI today reports that UK record label trade income1 rose by 7.3 per cent in 2019 to £1,069.8 million – marking the fourth consecutive year of growth and fuelled by the continuing increase in streaming income, which leapt by 21.8 per cent to stand at £628.9 million. This is the highest level of annual trade income in well over a decade going back to 2006, when the combined total was £1,166.2m.

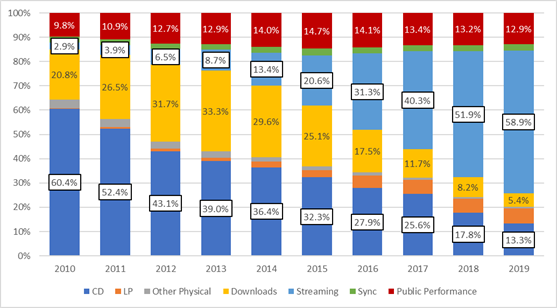

Record label trade income is made up of combined revenues generated through streaming, sales of music across physical and download formats, public performance rights, and 'sync' – music licensed for use in film & TV, games and advertising.

Geoff Taylor, Chief Executive BPI & BRIT Awards, said:

"Watching British artists such as Stormzy, Celeste, Dave and Harry Styles at The BRIT Awards was a reminder of the fantastic contribution music makes to our national life. The music industry's success is powered by record labels' up-front investment and shouldering of risk, so it is important to the sustainable health of the music ecosystem that label revenues grew on last year's results.

"But there is no room to rest on our laurels. British music faces intense competition at home and abroad, is undervalued by some tech platforms and is undermined by widespread illegal sites. In fact, total revenues remain more than a fifth below the post-Millennium peak recorded in 2001. It is time for a new partnership with Government to unleash the full potential of our music industry to benefit our culture and our economy."

Taylor also noted that UK record label A&R investment in new music typically accounts for up to a quarter (22-24%) of industry revenues from sales and streams annually2. Increasing totals allow greater investment into artist development, providing fans with more music to enjoy and kickstarting growth across the whole UK music ecosystem, including recording studios, publishing, live music, retail and digital services.

British artists backed to achieve domestic and global breakthroughs in recent years alongside more established stars, such as Ed Sheeran and Adele, include Lewis Capaldi, Dua Lipa, George Ezra, Jorja Smith, Rag'n'Bone Man, Anne-Marie, Dave, Mabel, Harry Styles, Jess Glynne, Tom Walker, Little Mix, Sam Fender, and Stormzy, to name a few. With the likes of BRITs Rising Star Celeste and BRITs Rising Star nominee Joy Crookes, BRIT School graduate Freya Ridings, and BRITs New Artist nominee Aitch now coming through the ranks along with others, this positive cycle looks set to continue.

Today's reported rise in revenues tracks the 7.5 per cent increase in consumption reported by the BPI earlier this year3. Within streaming, ad-supported audio streaming revenues were up strongly by 29.7 per cent, and video streaming revenues also grew by 18.8 per cent, but fell further behind the growth of other streaming channels. Vinyl delivered revenues of £66.3 million – up 16.1 per cent on the year.

This continuing growth in revenues is welcomed, but concerns remain around structural factors that are holding back the recorded sector from realising its full potential to reclaim the peak levels of two decades ago. Video streaming services failed to close the "Value Gap"4 in 2019, generating only just over half the income produced by vinyl records, while illegal websites, in particular P2P and "stream ripping"5 sites, continued to leach value from the recorded music sector online, estimated at £120 million6 per year.

Subscriptions drive streaming growth

Subscription represents the vast bulk of streaming revenues generated from services such as Spotify, Apple Music and Amazon Music Unlimited – responsible for 90.4 per cent (£568.8 million) of the 2019 total of £628.9 million. Income of £24.8 million from ad-supported tiers of audio streaming services now accounts for just 3.9 per cent of the streaming total – slightly below the £35.3 million (5.6% share) which video streaming ads contribute.

Streaming-generated revenues now make up the majority (58.8%) of record label trade income (with sync and public performance revenues included). Its significance to the industry is underlined by recent IFPI research7, which reports that nearly 4 in every 10 (39%) adults aged 16 or above now use a paid service. This is in line with the most recent estimates from MIDiA Research8 (for Q2 2019) that put the number of premium streaming subscribers in the UK at nearly 20 million (19.6m).

Physical formats remain resilient, with vinyl now accounting for over 6 per cent of total revenues

Whilst mainstream music consumption is now largely digital, physical formats continue to enjoy a healthy, complementary relationship with streaming as a valued part of the music eco-system.

At £215.8 million, physical made up a fifth (20.2%) of trade income in 2019. CD remained the dominant format – revenues of £141.7m representing 13.3 per cent of the overall total9 – but vinyl continues to catch up, rising 16.1 per cent to £66.3 million and accounting for 6.2 per cent of overall industry income.

'Sync' earnings also on the up

Revenues of £28.3 million generated from the licensing of 'sync' music for use in film & TV soundtracks, games and advertising in 2019 represented an 11.1 per cent rise on the year. This reflected the impact of music in films such as Last Christmas, which featured the songs of George Michael and Wham!, Bohemian Rhapsody and Rocketman, as well as the widespread use of music in games and advertising such as the seasonal campaigns for John Lewis and Tesco.

Notes

1 BPI's trade income report is based on a survey of its record label members, with Official Charts Company market share data used to account for labels who are not BPI members. The figures are verified against data collected by the IFPI. The growth reported is in line with the encouraging trend of recent years and is the highest annual amount that includes sync and public performance revenue since 2006, when the combined total was £1,166.2m. Record company earnings from public performance rights are generated by the broadcast and public performance of recorded music – the figures presented represent income collected on behalf of producers (i.e. record labels). Previously performance data has been excluded from the BPI trade income announcement, but it has now been included to give a more accurate representation of record company income. Pre-2019 data has been re-stated accordingly.

2 A&R & marketing investment estimates is based on regular BPI surveys of its members.

3 BPI Music consumption figures for 2019 here.

4 Value Gap describes the mismatch between the value that user upload services, such as YouTube, extract from music and the revenue returned to the music community – those who create and invest in music. The Value Gap is the biggest threat to the future sustainability of the music industry. It has come about because inconsistent applications of online liability laws have emboldened certain services to claim that they are not liable for the music they make available to the public. These services, which have developed sophisticated on-demand music platforms, use this 'safe harbour loophole' as a shield to avoid licensing music on fair terms like other digital services, claiming they are not responsible for the music they distribute on their site.

5 Stream ripping is typically described as a process by which everyday listeners can use software to illegally "rip" a file from a streaming platform, often YouTube, and convert it into a downloadable file. Organisations which promote and protect copyright, such as IFPI, have been taking action against stream-ripping sites – see here.

6 An estimated £122.4 million was lost to the music industry through digital piracy in 2019 according to the BPI. The BPI calculates this figure using its loss estimation model, with web traffic data from ComScore.

7 IFPI Music Consumer Study 'Music Listening 2019'.

8 For more MIDiA insights and information visit MIDiA Research

9 When evaluating the year on year performance of the physical sector, it should be remembered that in Q4 2018, HMV went (temporarily) into administration and some revenue was lost to the industry, thereby improving the year on year change in 2019.

Submit news or a press release

Want to add your news or press release? Email Paul or Kevin

Two week FREE trial